Mortgage Pre Approval Underwriting and Loan Qualification Tips

Jeannedarcherblay.com Assalamualaikum may we always do good. In This Post I want to share views on Mortgage, Approval that interesting. Content That Goes Into Mortgage, Approval Mortgage Pre Approval Underwriting and Loan Qualification Tips Make sure you listen to the entire contents of this article.

Mortgage Pre Approval Underwriting and Loan Qualification Tips

Mortgage pre approval is an essential step in the home buying process, giving you a clear understanding of how much you can borrow and making the process of finding a home much smoother.

Details

What is Mortgage Pre Approval?

Mortgage pre approval is a conditional commitment from a lender to provide you with a loan up to a certain amount. It involves an underwriting process where the lender reviews your financial information and assesses your ability to repay the loan.

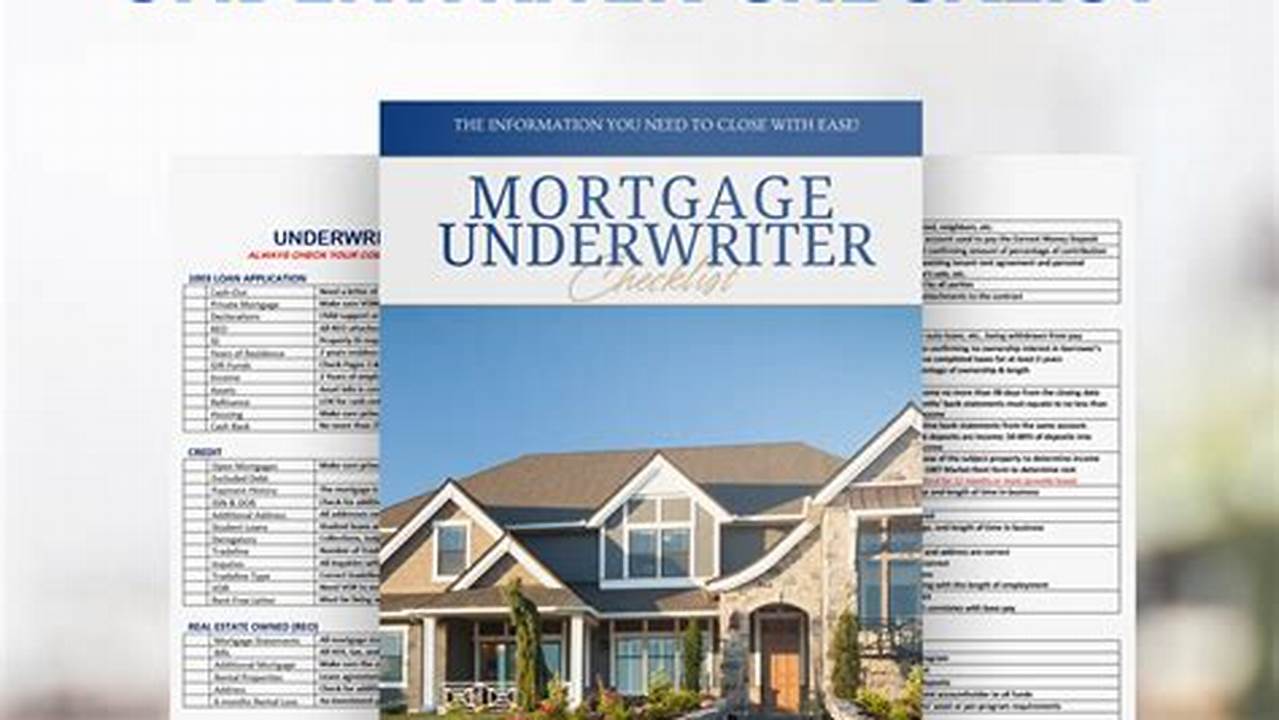

Underwriting Process

Underwriting is the process by which a lender evaluates your financial stability and creditworthiness to determine your eligibility for a mortgage. The lender will consider factors such as your income, debt-to-income ratio, credit score, assets, and employment history.

Loan Qualification

To qualify for a mortgage, you must meet the lender's credit, income, and debt requirements. Typically, lenders look for a credit score of at least 620, a debt-to-income ratio of less than 36%, and a stable income.

Documentation Required

To apply for pre approval, you will need to provide the lender with documentation such as pay stubs, tax returns, bank statements, and employment verification.

Benefits of Pre Approval

Pre approval offers several advantages, including providing you with a clear understanding of your borrowing power, making you a more competitive buyer in the housing market, and potentially securing a lower interest rate.

FAQ Section

What is the difference between pre approval and pre qualification?

Pre qualification is an initial estimate of how much you can borrow based on self-reported financial information, while pre approval is a more formal commitment from the lender after reviewing your financial documents.

How long does the pre approval process take?

The pre approval process typically takes 1-2 weeks, depending on the lender and the complexity of your financial situation.

Is pre approval binding?

Pre approval is not a guarantee of approval, as the lender may still deny your loan application if new information or changes in your financial situation come to light.

Pros Section

Mortgage pre approval offers several benefits, including:

- Provides a clear understanding of your borrowing power.

- Makes you a more competitive buyer in the housing market.

- Potentially secures a lower interest rate.

- Expedites the home buying process.

Tips Section

To increase your chances of mortgage pre approval, consider the following tips:

- Check your credit score and make any necessary improvements.

- Reduce your debt-to-income ratio by paying down debt or increasing your income.

- Obtain stable and verifiable employment.

- Gather all required documentation before applying.

Summary

Mortgage pre approval is an important step in the home buying process that provides you with a clear understanding of your borrowing power and makes the process of finding a home much smoother. By following the steps outlined above, you can increase your chances of mortgage pre approval and be on your way to homeownership.

Questions about Mortgage Pre Approval

Can I get pre approved for a mortgage with bad credit?

It is possible, but more challenging.

Lenders consider several factors beyond credit score, including your income, debt, and assets. A lower credit score may result in a higher interest rate.

How do I find a lender for mortgage pre approval?

You can find lenders online, through referrals, or by visiting local banks and credit unions. It's recommended to compare multiple lenders to find the best terms and rates.